Maximizing Value: Tips for Selecting Dental Insurance for Your Small Business

Dental insurance is a popular benefit for employees. It works similarly to health insurance and helps pay for cleanings and fillings.

Choosing the right plan for your small business is crucial. Compare plans and providers, looking at deductibles, net works and monthly premiums.

Find a Dentist You Can Trust

Providing dental insurance can reduce absenteeism and improve overall employee health. In addition, many medical conditions, such as diabetes, heart disease, respiratory disease, and cancer, are linked to poor dental care—these secondary health issues cause higher-cost medical claims, which drive up group insurance premiums.

Getting the most value from your dental insurance starts with selecting a plan that fits your business and employees’ unique needs. Look for a comprehensive oral health program that covers preventive services like cleanings and primary restorative care like fillings. It should also cover major therapeutic procedures such as root canals and crowns and orthodontic treatment like invisible braces.

A suitable small business dental plan balances access to great dentists with cost protections. It’s essential to understand what’s included in the program and if the insurer has a history of adjusting costs at renewal. For example, if a new carrier shows projected savings by pooling small employers together, ask where those savings are coming from — it may result in higher out-of-pocket costs for your employees.

Take Care of Your Teeth Regularly

All purchase decisions have a cost-versus-value analysis. While buying office supplies is an easy call, purchasing group dental insurance for your employees can be more complicated. Unlike many employer-provided benefits, small business dental plans are generally self-insured, so your carrier will likely project next year’s claims costs. This makes it more critical to evaluate your renewals carefully.

You’ll want to examine an insurer’s customer satisfaction rating and coverage options to do this. Choosing an insurer with higher ratings in these areas will help ensure your employees receive better service and more value from their coverage.

Offering employee-paid dental insurance is a great way to help attract and retain top talent. It can also improve productivity, as studies show that health-related issues cause workers to miss work and lead to lost revenue. When evaluating traditional dental insurance options, consider Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plan types and indemnity or discount plans. These plan types offer various coverage options tailored to your employees’ needs.

Get Regular Cleanings

Unlike other types of health insurance, dental plans are designed to take in more than they pay out. This is because dental insurance costs are typically planned, non-catastrophic events. For example, a dental cleaning is considered a non-catastrophic event because it is scheduled and involves no risk.

On the other hand, a toothache or a root canal is a catastrophic event because it is unscheduled and carries a substantial financial risk. This is why it is essential to keep up with routine cleanings to mitigate the cost of a potential catastrophe.

To maximize the value of your small business dental insurance, it is essential to encourage employees to schedule regular cleanings and use their benefits. You can do this by promoting the dental benefits your small business offers your employees and providing them with materials that help them understand how to utilize them. Additionally, you can check in with your employees during open enrollment to ensure they are using their benefits and maximizing the value of their policy.

Get Regular Checkups

Offering dental insurance is a great way to attract and retain employees. In addition, it can help them maintain a healthy level of productivity by reducing the likelihood that they need to take time off to deal with an unexpected oral health problem.

The cost of a plan is also an important consideration. Small business owners should look for programs with low-cost increases and a high-value rating, considering premiums and out-of-pocket costs.

For example, a company offers a variety of plan options. Their dental network is extensive and focuses on keeping costs reasonable. Their plan pricing is based on a UCR fee structure, meaning they only pay for a predetermined percentage of the usual, customary, or reasonable fees charged in a given geographic area.

Another option is a group dental savings plan. These plans offer a more affordable alternative to traditional dental insurance, with no deductibles or annual limits to monitor. They also allow members to use their group buying power to get discounts on dental work from an extensive network of dental professionals.

Get Dental Implants

The cost of dental implants can be prohibitive, even with insurance coverage. But with some research, there are ways to get the best value on these tooth replacement options.

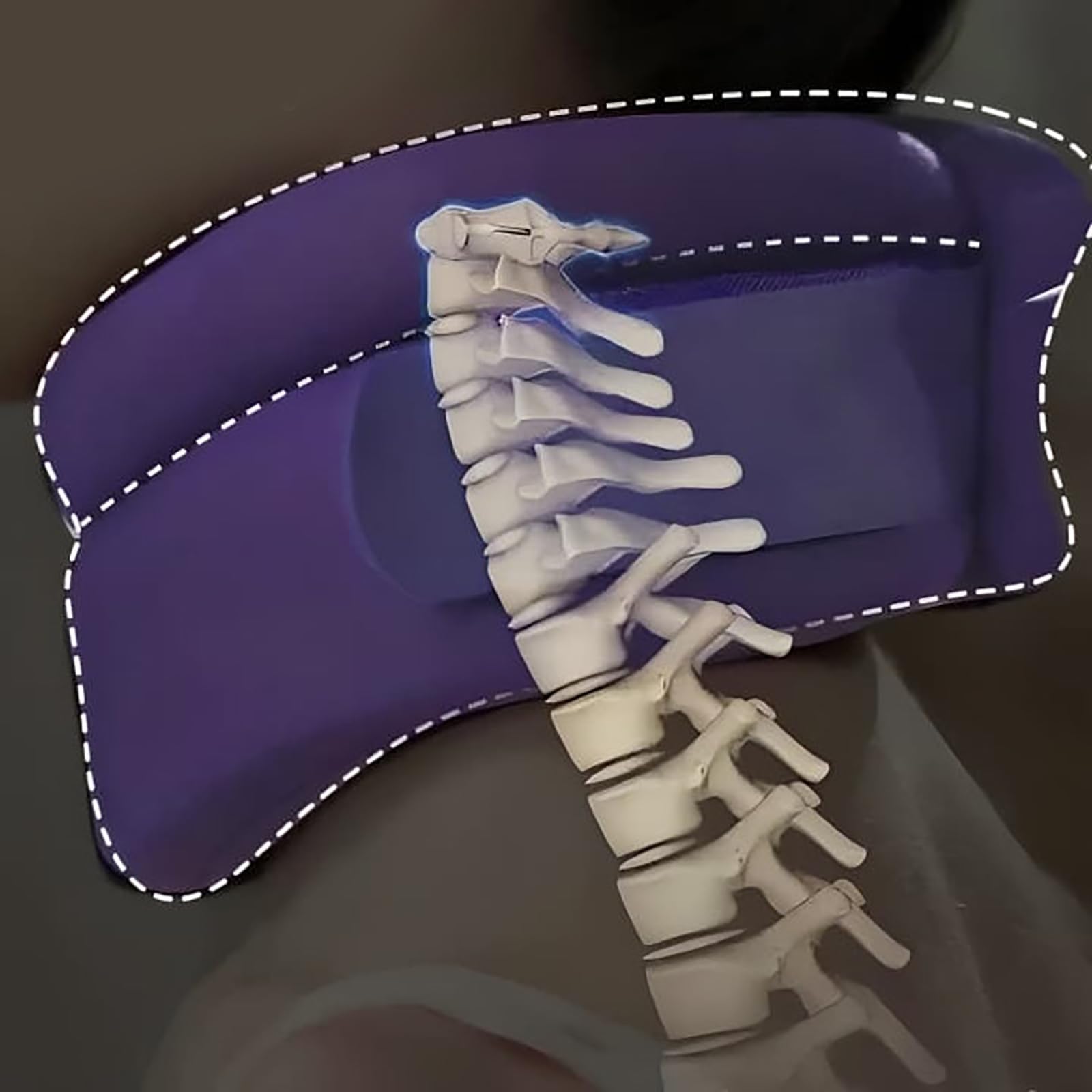

Dental implants are small titanium posts that replace a missing tooth’s root. They can be anchored to new crowns or dentures, and they’re known for their stability, longevity, and durability.

Some medical insurance plans, including Medicare, cover the cost of dental implants if they’re considered “medically necessary.” However, it’s essential to check with your plan provider.

Another option is a flexible spending account (FSA) or health savings account (HSA). These tax-advantaged accounts can be used to pay for out-of-pocket medical expenses, including dental implants. However, it’s important to note that you will need receipts and a letter from your dentist certifying that the procedure is medically necessary before filing a claim. If you don’t qualify for an FSA or HSA, there are also other alternatives to help with the cost of dental implants, such as using credit cards or financing.