What Does Pet Insurance Cover? – Detailed Guide

Introduction

What Does Pet Insurance Cover? pet ownership brings immense joy and companionship, but it also comes with responsibilities, including ensuring the well-being of your furry friends. One crucial aspect of responsible pet ownership is understanding and investing in pet insurance. In this comprehensive guide, we’ll explore the intricacies of pet insurance, specifically focusing on the coverage it provides.

Importance of Pet Insurance

Pet insurance serves as a safety net, offering financial assistance in unexpected circumstances. Whether it’s an accident, illness, or routine wellness care, having the right pet insurance can make a significant difference in your pet’s health and your peace of mind.

Coverage Types

Accident Coverage

Accidents can happen at any time, and veterinary bills can quickly accumulate. Accident coverage helps offset the costs of emergency treatments, surgeries, and medications.

Illness Coverage

From chronic conditions to sudden illnesses, this coverage addresses a wide range of health issues. It ensures that your pet receives the necessary medical attention without burdening your finances.

Wellness Coverage

While not always included in standard plans, wellness coverage focuses on preventive care. This may include vaccinations, annual check-ups, and dental care, promoting your pet’s overall health.

Factors Influencing Coverage

Breed and Age

Certain breeds are predisposed to specific health issues, and age plays a role in determining coverage eligibility. Understanding these factors helps tailor the insurance to your pet’s unique needs.

Pre-existing Conditions

Most policies do not cover pre-existing conditions, emphasizing the importance of securing coverage early in your pet’s life.

Understanding Exclusions

It’s crucial to be aware of what your pet insurance may not cover. Common exclusions include pre-existing conditions, elective procedures, and cosmetic treatments.

Tips for Choosing Pet Insurance

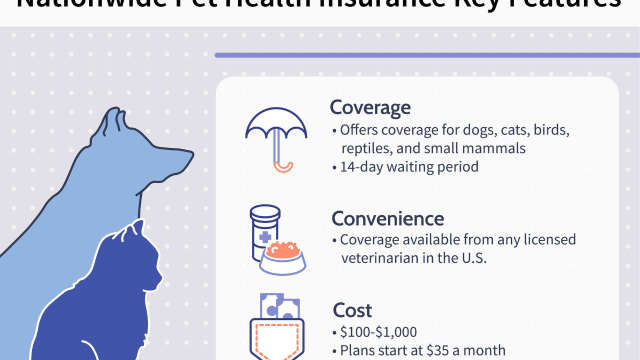

Research Providers

Thoroughly research different insurance providers, considering their reputation, customer reviews, and claim settlement processes.

Assess Coverage Options

Evaluate the coverage options offered by each provider. Ensure that the plan aligns with your pet’s specific needs and potential risks.

Consider Deductibles and Premiums

Balance the deductible amount and monthly premiums. Finding the right equilibrium ensures affordability while maintaining comprehensive coverage.

Real-life Scenarios

Case Studies

Explore real-life scenarios where pet insurance made a significant impact, highlighting its practical benefits and potentially life-saving role.

Common Misconceptions

Dispel common misconceptions surrounding pet insurance, such as it being unnecessary or too expensive. Understanding the facts helps pet owners make informed decisions.

Advantages of Pet Insurance

From financial security to ensuring prompt medical attention, the advantages of pet insurance extend beyond just cost savings. It provides peace of mind, allowing pet owners to focus on their pet’s well-being rather than financial concerns.